AI

How AI is Reshaping Financial Compliance and Risk Management

Artificial Intelligence is one of the most transformative technologies impacting financial compliance and risk management today. AI-driven tools are revolutionizing financial fraud, assessing risk, and ensuring regulatory compliance. As financial regulations evolve and market conditions shift, companies must adopt AI solutions to stay ahead of risks and maintain operational efficiency.

AI not only automates a process but also enhances decision-making, improves accuracy, and avoids risks that the human analyst would miss. Therefore, by bringing AI into the financial compliance and risk management fold, institutions reduce costs, avoid human error, and ensure, for the first time, that they can meet regulatory requirements.

The Role of AI

Financial institutions rely on AI to streamline their compliance and risk management strategies. Advanced AI-driven grc software gives automated solutions for monitoring transactions, identifying suspicious activities, and ensuring adherence to regulatory frameworks.

AI’s Impact on the Financial Industry

AI adoption in financial compliance is growing rapidly. According to a survey by KPMG, 68% of financial services firms prioritize AI for risk management and compliance functions. Additionally, a report by Thomson Reuters found that 78% of compliance professionals see AI as a force for good in regulatory compliance. These numbers highlight the increasing reliance on AI to navigate complex financial landscapes.

Enhancing Fraud Detection

Fraud detection has always been a major concern in the financial sector. Traditional fraud detection methods rely heavily on manual reviews and rule-based systems, which can be time-consuming and prone to human error. AI, on the other hand, offers a more advanced approach.

How AI Detects Fraud

AI-powered fraud detection systems analyze massive datasets in real-time, identifying patterns that indicate fraudulent activity. These systems use machine learning algorithms to continuously refine their detection techniques, making them more effective over time. Financial institutions can leverage AI to detect anomalies, flag suspicious transactions, and prevent fraud before it occurs.

Streamlining Regulatory Compliance

Regulatory compliance is a critical aspect of financial operations. Governments and regulatory bodies frequently update compliance requirements, making it challenging for businesses to keep up. AI simplifies compliance management by automating monitoring, documentation, and reporting.

Automating Compliance Monitoring

AI-driven compliance tools scan regulations and identify updates relevant to an institution’s operations. Natural language processing (NLP) technology helps AI understand legal documents, ensuring companies remain compliant without requiring manual intervention.

Reducing Compliance Costs

AI-driven compliance solutions help organizations reduce the cost of manual audits and reporting. According to a study by Deloitte, AI-driven compliance automation can lower operational costs by up to 30%. By reducing reliance on human analysts, companies can allocate resources more efficiently while ensuring compliance with regulatory frameworks.

Real-Time Risk Assessment

Risk assessment is essential for financial institutions to protect their assets and ensure stability. AI enhances risk management by providing real-time insights into potential threats and vulnerabilities.

Dynamic Risk Analysis

AI continuously analyzes financial data, market trends, and external factors to assess risks. Unlike traditional risk models that rely on static historical data, AI-driven risk assessment adapts to current market conditions, enabling organizations to make informed decisions in real time.

AI in Credit Risk Management

One key area where AI excels is credit risk assessment. AI-driven credit scoring models analyze a broader range of factors than traditional credit models, providing a more accurate representation of an individual’s creditworthiness. This approach benefits lenders by reducing default rates and improving loan approval processes.

Improving Decision-Making

AI not only identifies risks but also helps financial leaders make data-driven decisions. By analyzing large volumes of data, AI can predict market trends, assess investment risks, and recommend strategies that align with long-term financial goals.

Predictive Analytics in Finance

Predictive analytics powered by AI allows financial institutions to anticipate market shifts and adjust their strategies accordingly. By leveraging AI, companies can develop investment plans that maximize returns while minimizing risks.

AI in Investment Banking

Investment banks use AI-driven predictive models to identify profitable investment opportunities. For instance, several investment companies have integrated AI into their trading algorithms, improving the accuracy of their market predictions and enhancing profitability.

Challenges in AI Integration

Despite its advantages, integrating AI into financial compliance and risk management presents challenges. These challenges must be addressed to ensure that AI functions effectively and ethically.

Data Quality and Management

AI relies on high-quality data to deliver accurate insights. Poor data management can lead to inaccurate predictions and flawed decision-making. Financial institutions must invest in data governance frameworks to ensure AI systems operate with reliable data.

AI Transparency and Accountability

Another challenge is transparency. AI decision-making processes can be complex and difficult to interpret. Organizations must ensure that AI models are explainable and auditable to meet regulatory requirements and maintain public trust.

Ethical Considerations in AI

Ethical concerns surrounding AI in finance include bias, data privacy, and accountability. Organizations must implement AI in a way that aligns with ethical guidelines and regulatory standards.

Preventing Bias in AI Models

AI models can inherit biases from the data they are trained on. Financial institutions must conduct regular audits of their AI systems to ensure they do not perpetuate discriminatory practices.

Protecting Customer Data

With AI processing vast amounts of sensitive financial data, maintaining strong cybersecurity measures is crucial. Companies must adhere to data protection regulations to prevent breaches and protect customer information.

Future of AI in Financial Compliance and Risk Management

AI will continue to evolve, offering even more advanced capabilities for compliance and risk management. As technology improves, financial institutions will have access to more sophisticated tools that enhance efficiency and accuracy.

AI and Blockchain Integration

One emerging trend is the integration of AI with blockchain technology. Blockchain provides a tamper-proof record of transactions, while AI enhances fraud detection and compliance monitoring. This combination strengthens financial security and transparency.

The Role of Explainable AI (XAI)

Explainable AI (XAI) is gaining importance in financial compliance. XAI ensures that AI decisions are transparent and understandable, making it easier for regulators to assess compliance and for businesses to justify AI-driven actions.

Frequently Asked Questions

- How does AI improve fraud detection in financial institutions?

AI enhances fraud detection by analyzing large datasets to identify unusual patterns and anomalies indicative of fraudulent activities, allowing for proactive intervention.

- What are the main challenges in integrating AI into compliance functions?

Key challenges include ensuring data quality, managing ethical considerations such as bias and transparency, and aligning AI systems with existing regulatory frameworks.

- How can financial institutions address ethical concerns related to AI?

Institutions can implement robust data governance practices, ensure transparency in AI decision-making processes, and regularly audit AI systems to mitigate biases and uphold ethical standards.

Conclusion

AI is reshaping financial compliance and risk management by automating processes, improving fraud detection, and enhancing decision-making. While challenges exist, the benefits of AI in financial compliance far outweigh the risks. Financial institutions that embrace AI-driven solutions will be better equipped to navigate the complexities of the regulatory landscape and manage risks effectively.

As AI technology advances, its role in finance will only grow stronger. Institutions that invest in ethical and transparent AI adoption will gain a competitive edge, ensuring long-term success in an increasingly digital financial world.

AI

How AI Messenger Bots are Transforming the Future of Customer Engagement

In today’s fast-paced digital world, customers expect instant and personalized interactions. Whether it’s a simple product inquiry or complex troubleshooting, modern consumers want businesses to be responsive, available, and accurate. That’s where an ai messenger bot comes into play — transforming how companies communicate, serve, and retain their customers.

Businesses are no longer limited to human-only chat support or pre-set FAQs. The rise of intelligent automation means that conversational AI has become a crucial part of customer engagement strategies. These bots can interpret human intent, respond naturally, and even make decisions — all while maintaining brand consistency and tone.

Let’s explore how AI-powered messenger bots are redefining communication, driving efficiency, and creating personalized experiences at scale.

1. The Rise of the AI Messenger Bot

The concept of chatbots isn’t new — businesses have been experimenting with them for over a decade. However, the modern ai messenger bot is far more advanced. It uses machine learning, natural language processing (NLP), and contextual understanding to simulate human-like conversations.

Unlike traditional bots that rely on rigid scripts, today’s AI-driven bots can analyze a message’s intent, learn from interactions, and evolve over time. This makes them not just tools for answering FAQs but sophisticated conversational agents capable of understanding tone, emotion, and context.

Platforms like Kogents ai are leading this transformation, empowering organizations to deploy intelligent bots that can seamlessly handle everything from customer inquiries to lead generation and sales. By integrating with popular messaging apps such as Facebook Messenger, WhatsApp, and Instagram, these bots meet customers where they already spend their time.

2. Why Businesses Need AI Messenger Bots Today

Customers don’t just prefer instant support — they demand it. Studies show that more than 70% of users expect a response from brands within minutes. Traditional customer service setups, however, often struggle to meet this expectation, especially outside regular working hours.

An ai messenger bot ensures that your business never misses an opportunity to connect. These bots can operate 24/7, handle multiple queries simultaneously, and deliver accurate, on-brand responses every single time.

Here are some of the biggest benefits of using an AI-driven messenger bot:

- Instant Responses: No waiting times or queue frustrations.

- Personalization: Bots can remember previous interactions and tailor recommendations.

- Scalability: Handle thousands of simultaneous chats without additional staff.

- Cost Efficiency: Reduce overhead costs related to customer service teams.

- Consistency: Ensure every customer receives accurate and professional responses.

For businesses that want to stay competitive, adopting this technology isn’t a luxury — it’s a necessity. Solutions like the kogents ai messenger bot make it simple to implement automation while keeping the customer experience authentic and engaging.

3. How AI Messenger Bots Improve Customer Experience

A great customer experience is built on empathy, speed, and personalization. AI bots bring all three to the table.

Through natural language understanding, these bots can identify the intent behind a query and deliver precise responses. For instance, if a user types “I want to track my order,” the bot doesn’t just respond with a link — it retrieves the specific tracking information, provides delivery updates, and even offers related product recommendations.

Here’s how an ai messenger bot enhances user experience:

- 24/7 Availability: Customers get assistance anytime, anywhere.

- Personalized Interactions: Bots leverage customer data to provide tailored advice and product suggestions.

- Seamless Handoffs: When a query is too complex, the bot can transfer it smoothly to a human agent.

- Multilingual Support: Modern AI bots can converse in multiple languages, breaking down communication barriers.

- Emotion Recognition: Some bots can even detect frustration or confusion and adapt their tone accordingly.

With Kogents ai, businesses can design customer journeys that feel natural and intuitive. The brand’s advanced platform allows companies to train bots using real conversational data, ensuring each interaction feels personalized and contextually relevant.

4. Integrating AI Messenger Bots with Marketing Strategies

AI isn’t just transforming customer support — it’s reshaping marketing as well. Messenger bots have evolved into powerful marketing tools capable of driving conversions, upselling, and nurturing leads.

An ai messenger bot can automate the entire customer funnel — from initial awareness to purchase. Imagine a visitor landing on your social media page and instantly being greeted by a friendly bot offering discounts, product demos, or personalized recommendations. This proactive engagement not only improves conversions but also builds brand loyalty.

Marketing teams using the kogents ai messenger bot can leverage automation to:

- Send personalized promotional messages.

- Conduct customer surveys and gather feedback.

- Recommend products based on browsing behavior.

- Re-engage dormant customers through targeted reactivation campaigns.

- Schedule appointments or demos directly through chat.

This integration creates a unified experience that connects marketing, sales, and customer service seamlessly — all through a single conversational interface.

5. The Technology Behind Intelligent Messenger Bots

So, what makes a bot “intelligent”? It all comes down to the underlying technologies.

AI messenger bots are powered by three main components:

- Natural Language Processing (NLP): Enables bots to understand and interpret human language.

- Machine Learning (ML): Allows bots to learn from past interactions and improve over time.

- Integration Capabilities: Bots connect with CRMs, databases, and APIs to deliver real-time information.

For example, a bot built on the Kogents ai platform can integrate directly with Shopify, HubSpot, or Salesforce allowing businesses to sync conversations with sales pipelines or track user behavior across channels.

This blend of AI, data, and integration creates a dynamic system that not only responds to user messages but also anticipates needs, predicts behavior, and offers proactive support.

6. Real-World Use Cases of AI Messenger Bots

The applications for AI-powered messenger bots are virtually limitless. Here are some of the most impactful real-world examples:

- E-commerce: Bots help shoppers find products, track deliveries, and manage returns.

- Healthcare: Patients can schedule appointments, access test results, or get basic medical advice instantly.

- Finance: Banks use bots to provide account updates, loan details, and fraud alerts.

- Travel: Bots assist with bookings, itineraries, and travel recommendations.

- Education: Students can ask questions, receive course updates, and interact with virtual learning assistants.

Each of these industries benefits from improved communication, faster resolutions, and reduced operational costs. The key is in designing bots that align with business goals and customer expectations.

7. The Future of AI Messenger Bots

The evolution of AI and NLP means we’ve only scratched the surface of what’s possible. Future ai messenger bot systems will go beyond reactive communication — they’ll become proactive digital assistants capable of initiating meaningful interactions.

Imagine a bot that predicts when a customer might need support, recommends products before they’re searched for, or seamlessly transitions between chat, voice, and augmented reality environments.

With innovators like Kogents ai driving the next wave of automation, businesses will soon be able to offer experiences that are not just smart, but truly human-centric. The future belongs to organizations that can balance AI’s efficiency with emotional intelligence.

Conclusion

The shift toward AI-driven communication is undeniable. From small startups to global enterprises, businesses across industries are embracing messenger bots as essential tools for growth, engagement, and retention.

An ai messenger bot enables companies to meet customers where they are, provide instant support, and create experiences that feel personal and efficient. Meanwhile, platforms like the kogents ai messenger bot empower brands to harness AI’s full potential turning conversations into conversions.

As technology continues to evolve, embracing solutions like Kogents ai will ensure that your business stays ahead of the curve, delivering the kind of service and engagement modern consumers expect. The future of customer communication is here — and it’s powered by AI messenger bots.

AI

Unleash Your Twitter Potential: The Definitive Guide to AI Automation Tools in 2025

In the hyper-speed, ever-evolving world of social media, standing out on X (formerly Twitter) is a formidable challenge. Consistent, high-quality engagement is no longer a goal but a baseline requirement for relevance. For busy entrepreneurs, marketers, and creators, manual management is a fast track to burnout. This is where the power of automation becomes a game-changer. As we dive into 2025, the conversation has shifted from if you should automate to how you can do it intelligently.

This guide will explore the landscape of the best ai twitter automation tools 2025, showing you how to reclaim your time and supercharge your strategy. We’ll shine a spotlight on innovative platforms that are redefining what’s possible, with a special focus on the groundbreaking capabilities of Bika.

Why Smart Automation is Non-Negotiable in 2025

The manual approach to Twitter—endless scrolling, brainstorming on the fly, and posting whenever you have a free moment—is unsustainable. An AI Twitter agent automates these repetitive tasks, freeing you to focus on the bigger picture.

Here are the core benefits of integrating AI into your workflow:

- Massive Time Savings: Automate the entire process from content generation to posting, saving you hours each week.

- Unwavering Consistency: Maintain a steady stream of content to keep your audience engaged, even when you’re offline.

- Enhanced Content Quality: Leverage AI to generate creative, relevant, and on-brand tweets, moving beyond simple scheduling.

- Data-Driven Strategy: Utilize analytics to understand what resonates with your audience and optimize your posting schedule for maximum impact.

Choosing Your AI Co-Pilot: Key Features to Look For

When navigating the market for the best ai twitter automation tools 2025, it’s crucial to look past the hype and focus on features that deliver real value.

Must-Have Capabilities:

- AI-Powered Content Generation: The tool should be able to create original, engaging tweets from simple prompts or topics.

- Intelligent Scheduling: Look for platforms that can optimize posting times based on audience activity to maximize reach and engagement.

- No-Code, User-Friendly Interface: The best tools are powerful yet simple, allowing you to set up complex automation without any technical expertise.

- Comprehensive Analytics: A robust dashboard for monitoring key metrics like likes, retweets, and follower growth is essential for refining your strategy.

- Customization and Brand Voice: The AI should be adaptable, allowing you to define a specific tone and style to ensure all automated content is perfectly on-brand.

The Bika Advantage: More Than an Automator, It’s an Organizer

While many tools can schedule posts, Bika emerges as a leader by positioning itself as the world’s first “AI Organizer.” It’s not just another tool to manage; it’s a platform designed to build and coordinate an entire team of AI agents to run your operations. This makes it exceptionally powerful for solo entrepreneurs and small businesses aiming to scale their efforts without scaling their team.

What truly sets Bika apart?

Bika integrates AI agents, automation, databases, and dashboards into a single, seamless interface that feels as intuitive as a messenger app. This unique “agentic AI team” approach allows you to automate entire workflows, not just individual tasks.

How to Effortlessly Automate Your Twitter with Bika

Bika has simplified the process of creating a powerful, automated Twitter presence. Its “AI Automated X Tweets” template is a perfect example of its user-centric design. Here’s how it works:

Step 1: Install the Template and Connect Your Account

Getting started is as simple as installing the dedicated template from Bika’s library. You’ll then securely connect your X (Twitter) account through the integrations tab in your Bika space.

Step 2: Populate Your Content Database

The template includes a database named “X Tweet Content” where you’ll store your pre-written tweets. Simply add your text to the ‘Content’ field and, crucially, set a ‘Posting Date’ for when you want it to go live. The automation is designed to only pick up tweets that have a date assigned for the current day.

Step 3: Configure and Enable Your Automation

The core of the system is a pre-built automation that runs daily. It automatically finds all the records in your database scheduled for that day and posts them one by one. You can easily customize the time this automation runs to perfectly match when your audience is most active.

Step 4: Let Your AI Agent Take Over

Once you enable the automation, your work is done. Bika’s AI agent will handle the daily task of posting your scheduled content, ensuring your Twitter feed remains active and engaging without any manual intervention. To stop the posts, you simply disable the automation.

Automate Intelligently, Grow Exponentially

In 2025, winning on Twitter is about working smarter, not harder. The era of manual social media management is drawing to a close, replaced by intelligent, AI-driven strategies. By leveraging the best ai twitter automation tools 2025, you can save invaluable time, maintain a powerful and consistent online presence, and focus on what truly matters: growing your brand.

For those ready to move beyond simple scheduling and embrace a truly comprehensive solution, Bika offers a visionary platform that acts as your dedicated AI team. It’s an investment in efficiency, consistency, and scalable growth.

AI

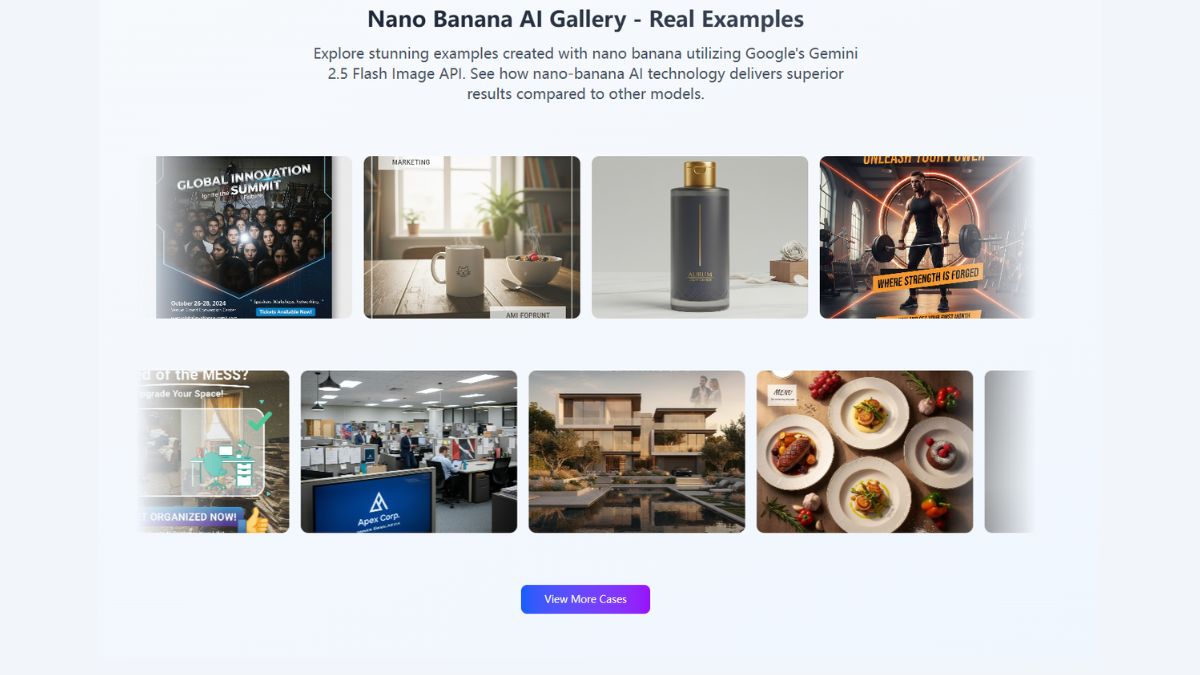

Hands-On Review: Does Nano Banana’s New AI Image Generator Live Up to the Hype?

The world of artificial intelligence is moving at a breakneck pace, especially in the realm of image generation. Just when we think we’ve seen it all with platforms like Midjourney and DALL-E, a new contender emerges, promising to redefine the boundaries of digital creativity. The latest to catch my eye is Nano Banana, an advanced AI image generator that makes a bold claim: it’s powered by Google’s state-of-the-art Gemini 2.5 Flash Image API.

As a tech reviewer who has tested dozens of AI tools, I’ve learned to temper my expectations. The promises of “perfect character consistency” and “revolutionary natural language editing” are common marketing refrains. But the connection to Google’s latest API was intriguing enough to warrant a deep dive. Is Nano Banana truly a leap forward, or just another drop in the AI ocean? I signed up to find out.

First Impressions: A Clean Entry into AI Art

My journey began on the Nano Banana homepage. The design is clean, modern, and refreshingly free of the clutter that plagues many new tech platforms. It gets straight to the point, showcasing stunning example images and highlighting its core features. The message is clear: this tool is about power and simplicity.

Getting started was a breeze. The platform offers new users 5 free credits, which, according to their pricing model, is enough to generate two images (as each generation costs 2 credits). This is a smart move, as it provides a risk-free opportunity to test the service’s core functionality. After a quick sign-up, I navigated directly to the AI Image Generator.

The generator interface itself is a testament to minimalist design. You’re presented with two primary modes, “Text to Image” and “Image to Image,” a prompt box, and a few basic settings like the number of images to generate. There’s no overwhelming sea of sliders and toggles. For users who might be intimidated by more complex platforms, this straightforward approach is a significant advantage. It invites you to start creating immediately.

Putting the Generator to the Test: From Simple Prompts to Complex Characters

It was time to burn my free credits and see what this engine could do. I decided to start with a classic, descriptive prompt, similar to one of their examples:

Prompt 1: “A breathtaking sunset over the mountain peaks with golden clouds floating in the sky.”

I hit “Generate Image” and waited. The generation speed was impressive—within about 20 seconds, my image appeared. The result was genuinely stunning. The AI didn’t just create a generic sunset; it captured the subtle interplay of light and shadow, the soft diffusion of golden hour light through the clouds, and the majestic scale of the mountains. The colors were vibrant but realistic, avoiding the overly saturated look some models produce.

For my second and final free generation, I wanted to test one of Nano Banana’s biggest claims: superior character consistency. This is a well-known pain point for AI artists, where generating the same character across different scenes is often a frustrating exercise in trial and error.

Prompt 2: “Photorealistic portrait of a female scientist with kind eyes and silver hair tied in a bun, wearing a white lab coat, working in a futuristic laboratory with glowing blue holographic displays.”

This prompt was more complex, with specific details about the character and her environment. Again, the result was remarkable. The portrait was incredibly detailed, from the fine lines around the scientist’s eyes to the subtle texture of her lab coat. The background was equally impressive, with the holographic displays casting a soft, blue glow on her face, demonstrating a sophisticated understanding of light and environment. While a single image can’t fully validate the claim of multi-image consistency, the level of detail and identity preservation in this one generation was a very promising sign. It felt less like a random generation and more like a snapshot of a real person in a real place.

The Promised Land: Advanced Features That Set Nano Banana Apart

While the text-to-image generator is the main attraction, Nano Banana’s true potential seems to lie in its advanced editing features. According to the site, the platform goes far beyond simple generation.

- Prompt-Based Local Edits: This is the holy grail for many creators. The promise is the ability to upload an image and make targeted changes using natural language commands like, “Change the color of her dress to red” or “Add a pair of glasses to his face.” The platform claims it can do this without altering the character’s identity or disrupting the overall composition, a feat that would make it superior to traditional photo editing tools for many tasks.

- Character Identity Preservation: This is the feature I was testing with my second prompt. Nano Banana claims its model, powered by Gemini 2.5 Flash, excels at maintaining facial identity and style across multiple edits and generations. For storytellers, marketers, and comic artists, this is a game-changer, enabling the creation of consistent narratives with recurring AI-generated characters.

- World Knowledge Integration: By leveraging Gemini’s vast knowledge base, the AI understands real-world context. This means it can generate historically accurate scenes, recognize famous landmarks, and understand complex relationships between objects, leading to more coherent and believable images.

These features, particularly the in-painting and editing capabilities, position Nano Banana as more than just a generator—it’s aiming to be a comprehensive AI image editing suite.

A Look at the Pricing Structure: Is It Worth the Investment?

Free credits are great, but for any serious creator, a subscription is necessary. Nano Banana uses a credit-based system, which is transparent and easy to understand: 1 image generation costs 2 credits.

The platform offers three main monthly subscription tiers:

- Basic ($9.99/mo): Includes 100 credits, enough for 50 high-quality images. This plan is perfect for hobbyists, students, or anyone who needs to generate images occasionally.

- Pro ($29.99/mo): The most popular plan, offering 500 credits (250 images). It adds priority generation, enhanced customer support, and additional format downloads. This tier is clearly aimed at professional creators, social media managers, and small businesses.

- Max ($79.99/mo): Designed for heavy users and enterprises, this plan provides 1600 credits (800 images), the fastest generation speeds, and a dedicated account manager.

The Pro and Max plans also mention that advanced image editing tools and a professional editing suite are “Coming in October,” which further solidifies the platform’s ambitious roadmap. For those willing to commit, a 20% discount on yearly plans adds significant value. Compared to other services on the market, the pricing feels competitive, especially given the advanced capabilities promised by the underlying Gemini API.

Final Verdict: A Powerful and Promising Tool for the Future of Creativity

After spending time with Nano Banana, I can say that it does more than just talk the talk. While I was only able to scratch the surface with the free trial, the quality of the initial generations and the promise of its advanced feature set are incredibly compelling. The platform successfully marries the raw power of Google’s latest AI with a user-friendly interface that is accessible to beginners and professionals alike.

Its key differentiators—unmatched character consistency, intuitive natural language editing, and deep world knowledge—are the very features that today’s digital creators are clamoring for. Nano Banana isn’t just another image generator; it’s a sophisticated tool that feels like a genuine step forward.

If you are a digital artist, a marketer looking for unique content, or simply an AI enthusiast curious about the next wave of innovation, I highly recommend giving Nano Banana a try. The future of AI-powered creativity may very well be spelled B-A-N-A-N-A.

-

TECHNOLOGY7 months ago

TECHNOLOGY7 months agoTop 10 Must-Read Stories from Kristen Archives You Can’t Miss

-

TECHNOLOGY1 year ago

TECHNOLOGY1 year agoSky Bri Net Worth Revealed: How She Built Her Financial Empire

-

TOPIC1 year ago

TOPIC1 year agoBasement Renovation Contractors: How They Tackle Structural Issues During Renovations

-

TOPIC9 months ago

TOPIC9 months ago5 Reasons the //Vital-Mag.Net Blog Dominates Lifestyle

-

TOPIC8 months ago

TOPIC8 months agoTop 10 Articles from the ://Vital-Mag.net Blog That You Can’t Miss

-

BEAUTY1 year ago

BEAUTY1 year agoRevitalize Your Hair with Oribe Hair Care for Damaged Hair: Style It with Blue Dresses for Weddings and Events

-

CRYPTO11 months ago

CRYPTO11 months agoCrypto30x.com Review: Is It the Right Platform for You?

-

BUSINESS7 months ago

BUSINESS7 months agoTraceLoans Explained What You Need to Know